IRS Form 1098-T

The IRS Form 1098-T that you received is your notice from RTC that you or the person who claims you as a dependent may be eligible for an Education Tax Credit. There is no need to attach the 1098-T form to your tax return. Depending on individual circumstances, the amount listed on the 1098-T form may or may not be the correct amount to report on IRS Form 8863, Education Credits. It is important that you recalculate your out-of-pocket expenses for tuition to ensure that you receive any tax credit for which you are eligible. To claim the tax credit, you must complete IRS Form 8863 and file it with your tax return.

- Retrieve your 1098T - Tuition Statement

- Retrieve form 8863 from the IRS

- IRS: Why Form 1098-T is important to you?

- IRS: About Form 1098-T, Tuition Statement

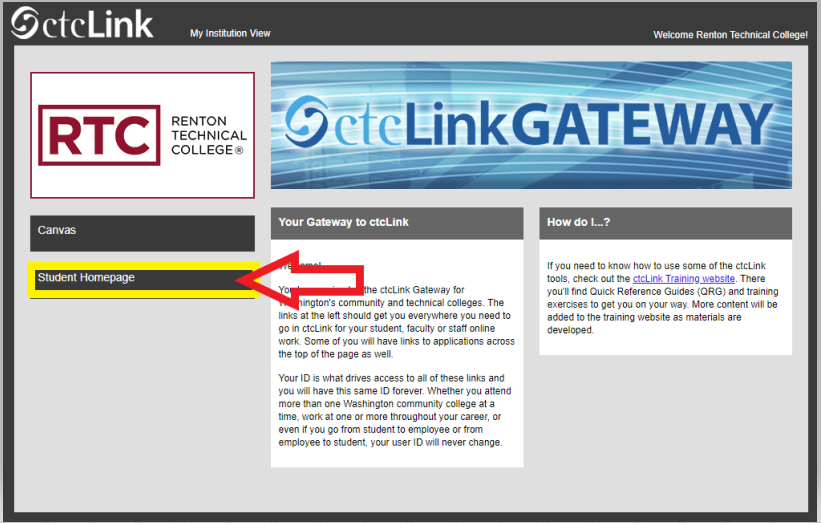

- Log in to your ctcLink student account using your student ctcLink ID and Password

- On the ctcLink Gateway, select the Student Homepage tile

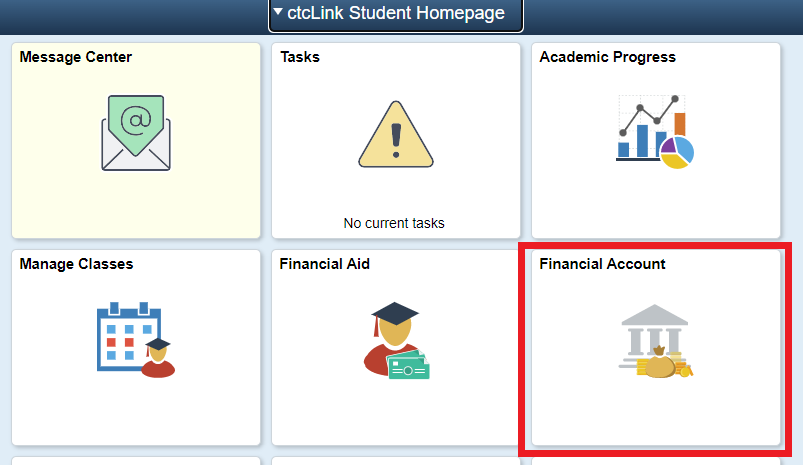

- Select the Financial Account tile

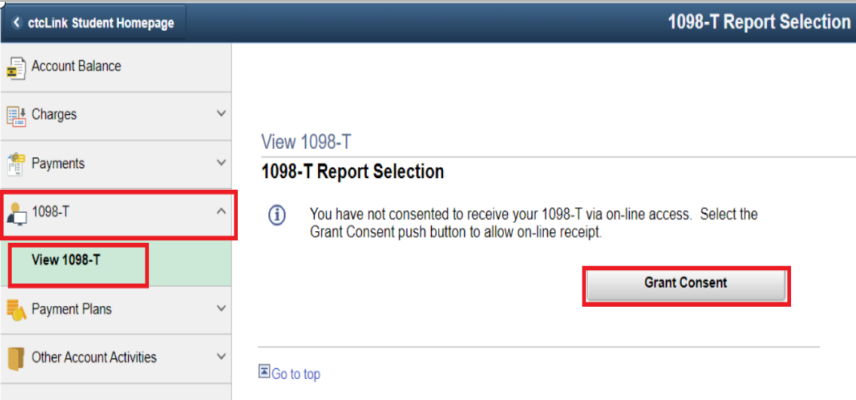

- Select the 1098-T button on the left menu to expand and show the View 1098-T option;

click the Grant Consent bottom

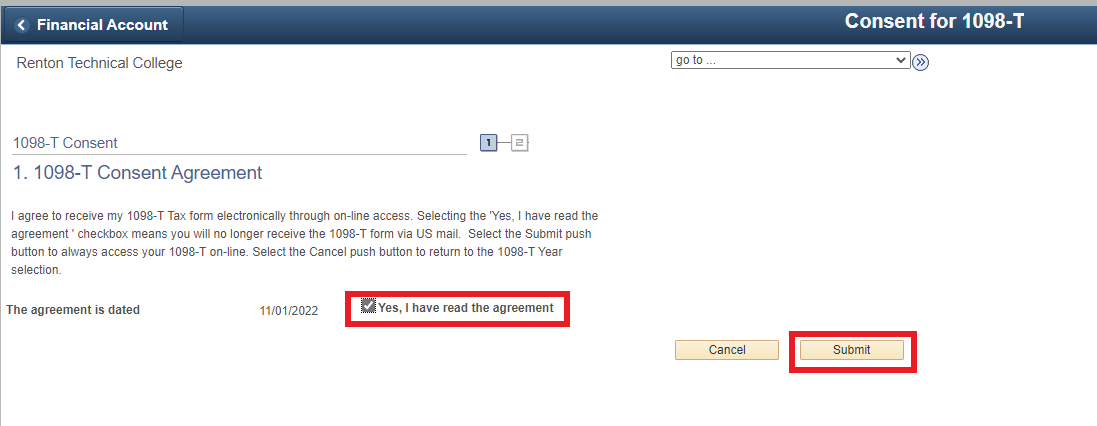

- Select the "Yes, I have read the agreement" checkbox and then click Submit button

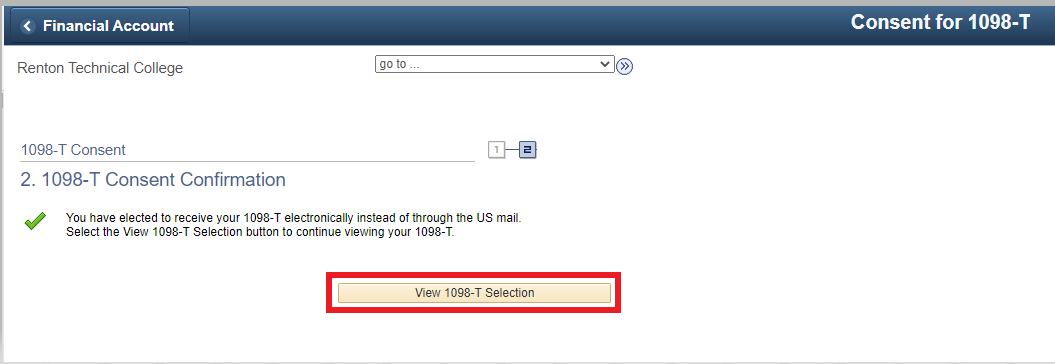

- 1098- T Consent Confirmation displays; Click “View 1098-T Selection”

Note: A Form 1098-T will report any qualifying payments made out of pocket, over and above any grants, scholarships, or other funding received. If there were no qualifying payments, the college would not generate a 1098T since there is nothing that would qualify for the tuition credit.

Background Information on the Education Tax Credits

Congress passed legislation in 1997 creating the opportunity for certain students or their parents to obtain a tax credit for tuition paid to attend a college or university. Congress has required that beginning with calendar year 1998, colleges and universities report both to the IRS and to students, certain information relating to their attendance at the college or university.

RTC cannot provide personal tax advice to students, as each student will be affected differently based on his or her individual circumstances. Taxpayers should contact their tax adviser for assistance in claiming the tax credit.

For authoritative information, please review IRS Publication 970, "Tax Benefits for Higher Education", at http://www.irs.gov/pub/irs-pdf/p970.pdf or call the IRS at 1-800-TAX-FORM (829-3676).

Additional information on Federal Tax Benefits for students and parents. http://www.nasfaa.org/publications/2009/antax010809.html